Manage product prices for B2B (tax excluded) and B2C (tax included)¶

When working with consumers, prices are usually expressed with taxes included in the price (e.g., in most eCommerce). But, when you work in a business environment, companies usually negotiate prices without taxes.

You can manage both use cases easily, as long as you register your prices on the product with taxes excluded or included, but not both together. If you manage all your prices with tax included (or excluded) only, you can still easily do sales order with a price having taxes excluded (or included): that’s easy.

Let’s see how you can manage the product pricing for both customer at once. When you have a retailer customer on eCommerce store you can show the price and send the quotation with tax included in price and for same product you can prepare and send the quotation excluded price for back office sales to the business customer.

Configuration¶

The best way to simplify the price by setting the product price as tax excluded by default, so all the price defined on the product are always tax excluded. The other way will be computed automatically.

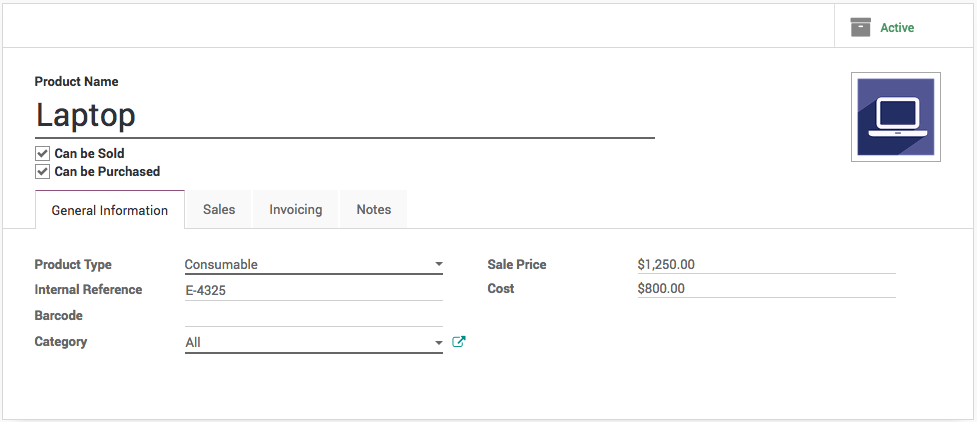

Product Price¶

Make sure that when you define the product price it will always tax excluded, and apply the default tax on the product form.

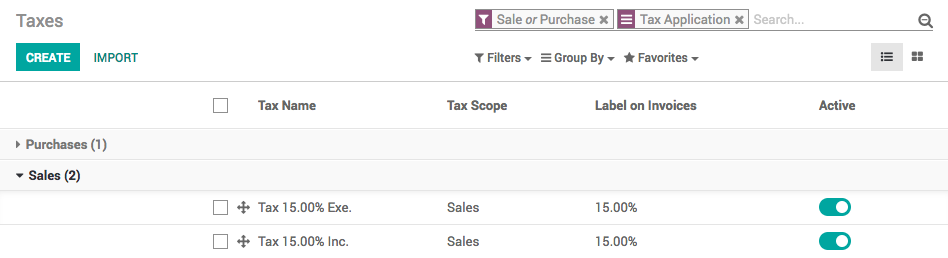

Create taxes¶

Create a different taxes with the same percentage 15%, one define as Included in Price and for other one which is tax excluded rename the existing ‘Tax 15.00%’ to ‘Tax 15.00% Exe.’

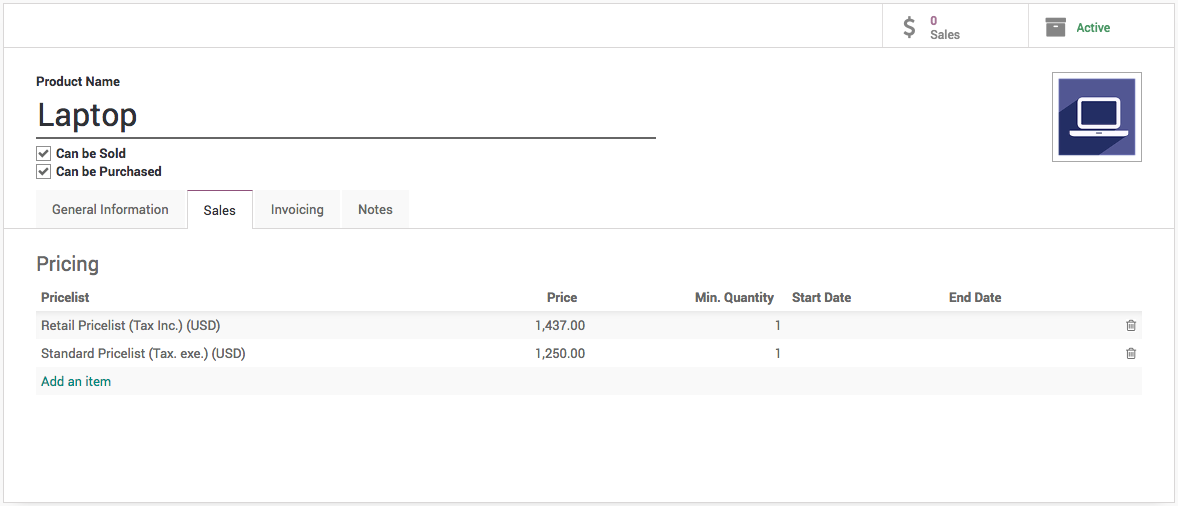

Price List¶

Create a pricelist that have the product price always tax included. So, If you define the product Laptop price $1250 and default tax is 15% define the product price on price list as $1437.5.

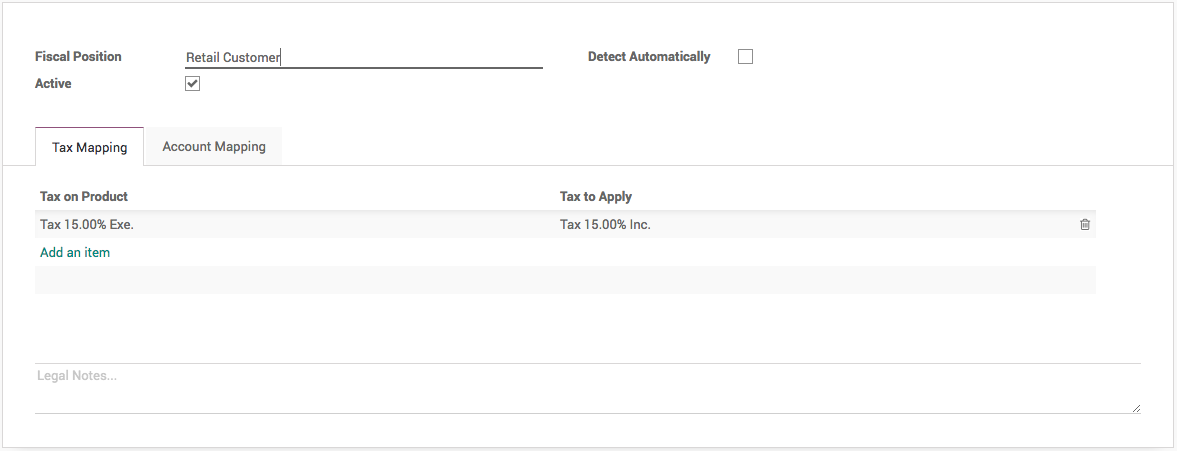

Create a Fiscal Position¶

Create a fiscal position that use to swap taxes. When you are selling to wholesale(b2b) customer, the default tax we have applied on the product is always tax excluded but when you sell to retail customer you have to apply the price which is tax included and tax which actually computed the tax included.

Create a retail customer (b2c)¶

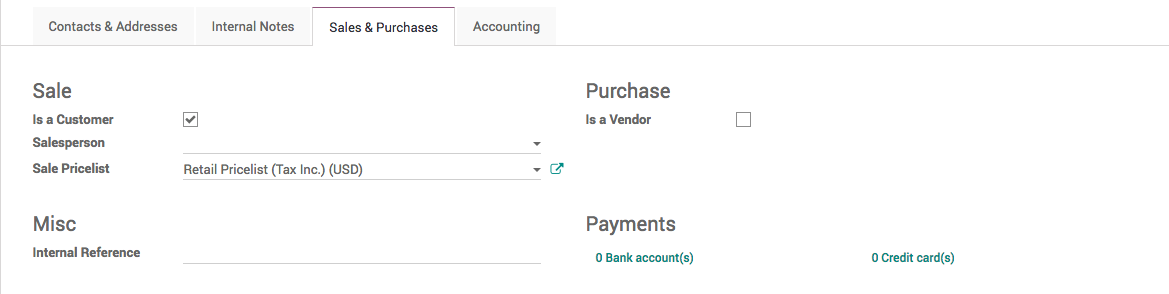

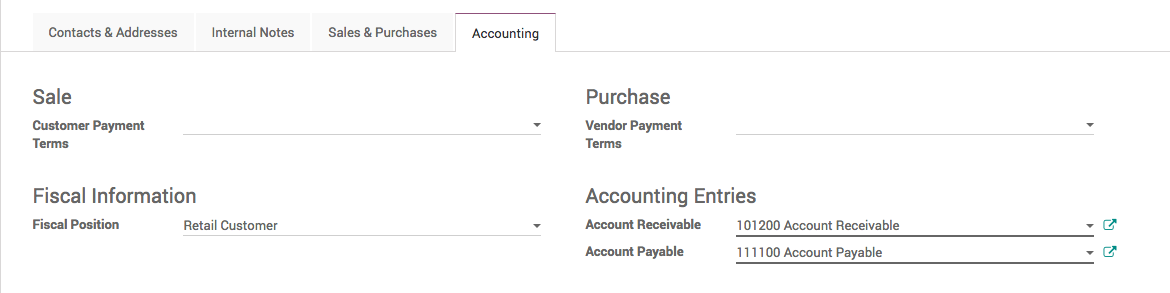

There are two important fields has to be set correctly when you create a

retail customer, Sales Pricelist has to be set to Retail

Pricelist (Tax. Inc.) (USD) under the Sales & Purchase tab.

The Fiscal Position should be set to Retail Customer under the Accounting and tab.

Create a normal customer (b2b)¶

By default all the customer are created are considered as business customers with the default pricelist and tax is applied which is always the tax excluded.

Create a test quotation¶

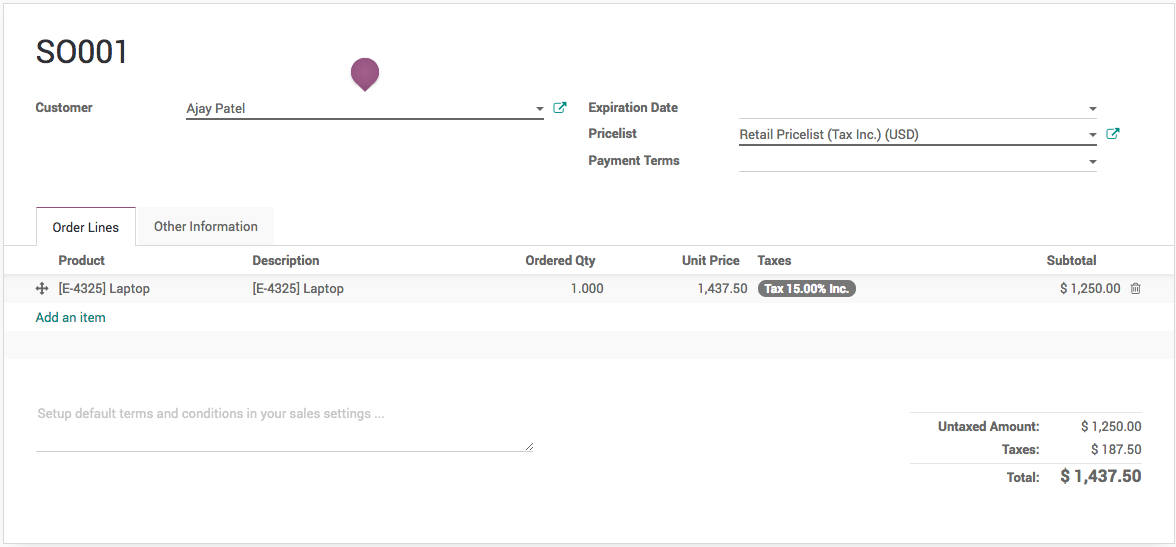

Create a quotation from the Sale application, using the Sales / Quotations menu. Select the Ajay Patel as a customer, sell Laptop product, you should have the following result: 1250€ + 187.50€ = 1437.50€.

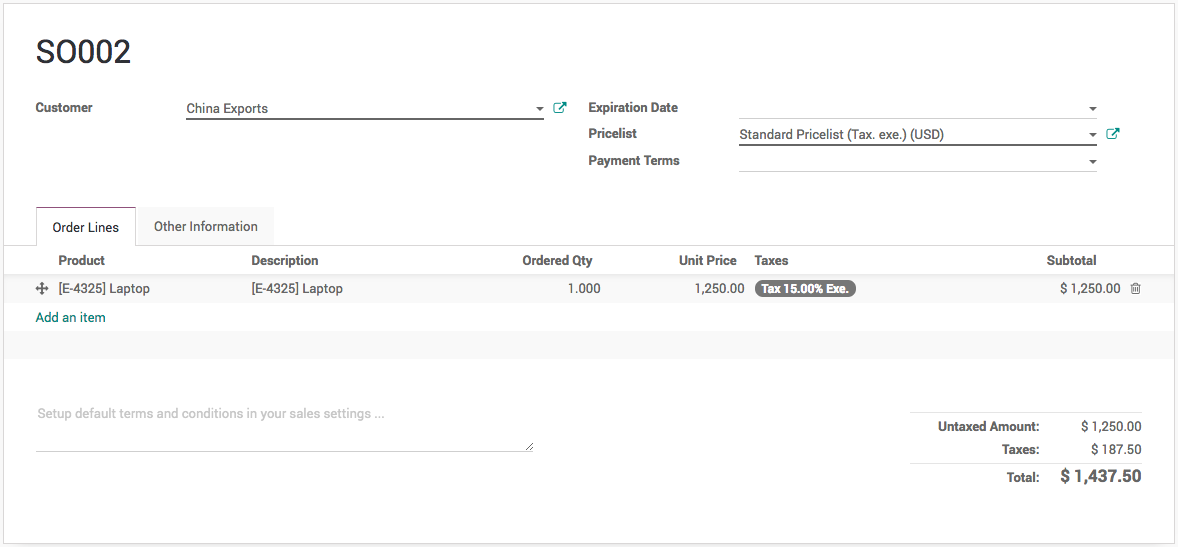

When you create a quotation for the normal customer which has tax excluded will be looking as below.

Tip

If you negotiate a contract with a customer, whether you negotiate tax included or tax excluded, you can set the pricelist and the fiscal position on the customer form so that it will be applied automatically at every sale of this customer.